Junxiong Gao

I am a job market candidate majored in finance at UCSD, Rady School of Management. My research interest inlcudes empirical and theoretical asset pricing, and macro finance.

Email: jug027@ucsd.edu

CV .

-

Ph.D. in Finance, 2023 (expected)

University of California San Diego

-

M.S. in Finance

University of California San Diego

-

B.S. in Statistics

University of Science and Technology of China, School of gifted young

Research

Working Papers:

-

Granular Asset Pricing (Job Market Paper)

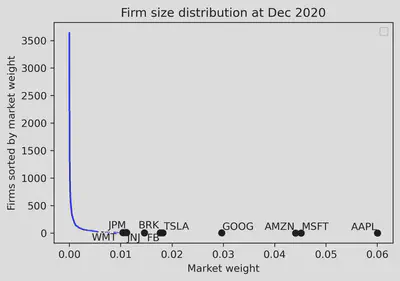

- Abstract: The market capitalization distribution of US firms has a fat tail populated by the largest firms. I refer to this fat tail as granularity and show it breaks the diversification of idiosyncratic risks assumed by arbitrage pricing theory (APT) to imply factor models. In cross-section, large firms have higher idiosyncratic risk premiums than small firms despite having a lower level of risk. This finding explains the negative relation between idiosyncratic risk and risk premium, known as the “idiosyncratic risk premium puzzle.” On aggregate, the level of granularity, measured by the Pareto distribution, explains market expected returns since it determines the under-diversification of idiosyncratic risk.

- paper latest version .

-

Fiscal Imbalances, Foreign Account Imbalances, and Asset Returns (with Rossen Valkanov, and Yan Xu)

-

Estimate Conditional Correlation with Factor Structure

* paper latest version .

Teaching

Teaching Assistant, UC San Diego:

-

MGTF404: Financial Econometrics and Empirical Method

- A core class of Master Finance program

- Hold review session weekly, prepare python code for homework and class illustration

- Main Modules: hypothesis testing, regression analysis, maximum likelihood estimation, general methods of moments, Kalman filter

-

A sample of my review session note

here

.

-

MGTF 403: Advanced Financial Risk Management

- A core class of Master Finance program

- Hold review session weekly, prepare python code for homework and class illustration

- Main Modules: Value-at-Risk analysis, GARCH model, portolio immunization, derivative pricing

-

MGTF 411: Stochastic Calculus and Continous Time Finance

- Elective classes of Master Finance program

- Main Modules: Black-Scholes PDE, risk-neutral measure, Feyn-Kac formula, portfolio and consumption choice, term structure of interest rates